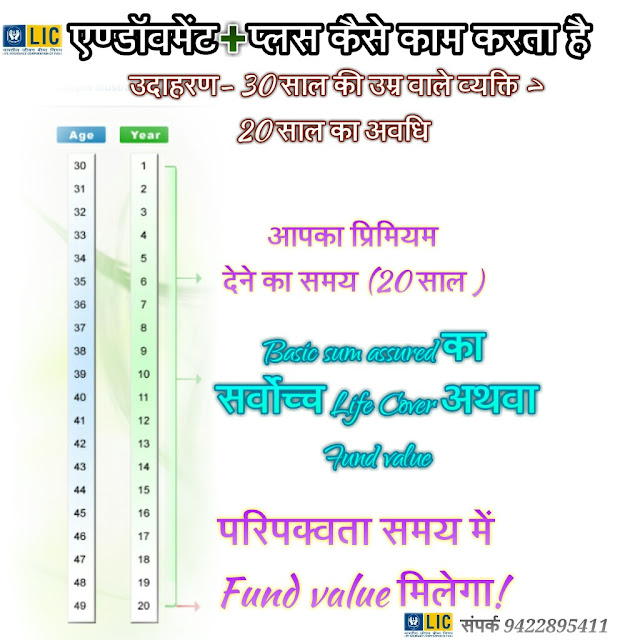

LIC Endowment Plus .. एलआईसी कि एण्डाॅवमेंट प्लस

LIC Endowment Plus

👉Ulip plans are investment plans for those who realise the worth of hard-earned money. These plans help you see your savings yield rich benefits and help you save tax even if you don't have consistent income.

👉A unit linked assurance plan, offering investment-cum-insurance during the term of the policy..

👉This Plan allows policyholder to decide the amount of premium he/she can pay. There is a option to choose from 4 funds for investment.

Bond Fund

Secured Fund

Balanced Fund

Growth Fund

A pre-specified percentage shall be deducted upfront from the premium as Premium Allocation Charges. This charge is levied to meet the cost of issuing policy such as distributor fee and cost of underwriting.

👉Premium Allocation Charge

1st Year 7.50%

2nd to 5th Year 5.00%

thereafter 3.00%

👉Death Benefits : In the event of death of life assured before the date of maturity, the sum payable would be:

Upto age 8 years of the Life Assured OR before completion of 2 policy years

An amount equal to the Policyholder’s fund value immediately on the date of receipt of the intimation of death with death certificate.

Age 8 years and above of the Life Assured OR after completion of 2 policy years

An amount equal to the higher of Basic sum assured (i.e. higher of 10 X Annualized Premium or 105% of total premiums paid); or Policyholder’s Fund Value.

👉Optional Double Accidental Death Benefit rider up to Rs.1 Crore. It can be availed by just paying Rs.40 per Lac.

Maturity Benefits on completion of policy term: An amount equal to the policyholder’s fund value shall be payable. This amount can either be taken at once or in installments as chosen.

👉Tax Benefits:

The Maturity proceeds under the plan will be tax-free under section 10(10D) of Income Tax Act.

Enjoy Income tax benefit on premiums paid under section 80C of Income Tax Act.

👇Eligibility Criteria

👉Minimum Age : - 90 days

Maximum Age :- 50 years

👉Minimum Term:- 10 years

Maximum Term:- 20 years

👉Sum Assured:- Higher of 10 times of annualized premium or 105% of total premium Paid

👉Minimum Premium Yearly 20,000

Half Yearly 13,000

Quarterly 8,000

Monthly (ECS) 3000

👉Maximum premium:- No Limit

👉Modes:- Yearly, Half Yearly, Quarterly, Monthly (ECS)

Comments

Post a Comment